Get the free ct os 114 mail paper 2015 form

Show details

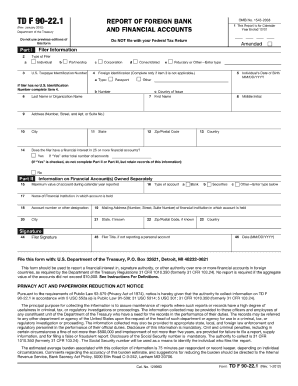

Department of Revenue Services PO Box 5030 Hartford CT 06102-5030 (Rev. 07/11) Form OS-114 Sales and Use Tax Return For period ending See Form O-88, Instructions for Form OS-114 Sales and Use Tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ct os 114 mail form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct os 114 mail form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct os 114 mail paper 2015 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit os 114 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

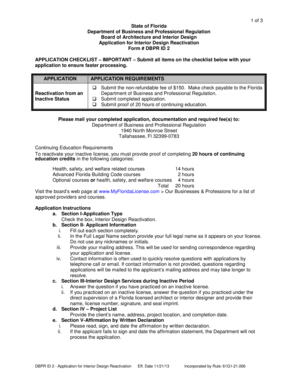

How to fill out ct os 114 mail

How to fill out ct os 114 mail:

01

Start by gathering all necessary information and documents required for filling out the ct os 114 mail form. This may include personal identification details, income information, and any supporting documentation related to your tax obligations.

02

Carefully read and understand the instructions provided on the form. Make sure you have a clear understanding of the purpose of the form and the specific sections that need to be completed.

03

Begin by filling out your personal information, such as your name, address, and social security number, in the designated fields on the form. Ensure that all information provided is accurate and up to date.

04

Proceed to the income section of the form, where you will be required to report your income details. This may include wages, tips, interest, dividends, or any other sources of income you have earned within the given tax period. Enter the relevant amounts in the appropriate fields.

05

If applicable, complete the deductions and exemptions section, where you can claim any eligible deductions or exemptions that may reduce your taxable income. This may include deductions for mortgage interest, student loan interest, or medical expenses.

06

Review your completed form thoroughly to ensure all information is accurate and no sections have been left blank. Check for any errors or discrepancies, as these could lead to delays or issues with your tax return.

07

Sign and date the form in the designated area to certify that the information provided is true and correct to the best of your knowledge.

08

Make a copy of the completed ct os 114 mail form for your records before mailing it to the appropriate tax authority. Retain any supporting documentation as well.

09

It is recommended to keep a copy of the mailed form and any supporting documents in a safe place in case you need to reference them in the future or in case there are any inquiries or audits concerning your tax return.

Who needs ct os 114 mail:

01

Individuals who are required to file their taxes and fulfill their tax reporting obligations to the appropriate tax authority may need to use the ct os 114 mail form.

02

The specific requirements for filing the ct os 114 mail form may vary depending on the tax jurisdiction and individual circumstances. It is essential to consult with a tax professional or refer to the guidelines provided by the tax authority to determine if the ct os 114 mail form is required in your particular case.

03

Generally, individuals who have earned income from various sources and need to report this income to the tax authority may need to fill out the ct os 114 mail form. This could include employees, self-employed individuals, freelancers, or those with investment income.

04

It is important to stay informed about the tax regulations and requirements in your jurisdiction to ensure compliance with the law and to avoid any penalties or legal consequences for non-compliance. Seeking professional advice or consulting official tax resources can help individuals determine if they need to fill out the ct os 114 mail form.

Video instructions and help with filling out and completing ct os 114 mail paper 2015

Instructions and Help about ct os 114 mail

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ct os 114 mail?

CT OS 114 mail is a form used to report certain financial information to the IRS.

Who is required to file ct os 114 mail?

Any individual or entity that meets the filing requirements set by the IRS is required to file CT OS 114 mail.

How to fill out ct os 114 mail?

CT OS 114 mail can be filled out online or by mail, following the instructions provided by the IRS.

What is the purpose of ct os 114 mail?

The purpose of CT OS 114 mail is to report certain financial information to the IRS for tax purposes.

What information must be reported on ct os 114 mail?

CT OS 114 mail requires reporting of specific financial information, such as income, expenses, and other relevant details.

When is the deadline to file ct os 114 mail in 2023?

The deadline to file CT OS 114 mail in 2023 is typically April 15th, but it is recommended to check with the IRS for any updates or changes.

What is the penalty for the late filing of ct os 114 mail?

The penalty for late filing of CT OS 114 mail can vary depending on the specific circumstances, but it may include fines or interest charges.

How do I modify my ct os 114 mail paper 2015 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your os 114 form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send os 114 fillable form for eSignature?

os114 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in os 114 form for ct?

The editing procedure is simple with pdfFiller. Open your form os 114 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Fill out your ct os 114 mail online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Os 114 Fillable Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.